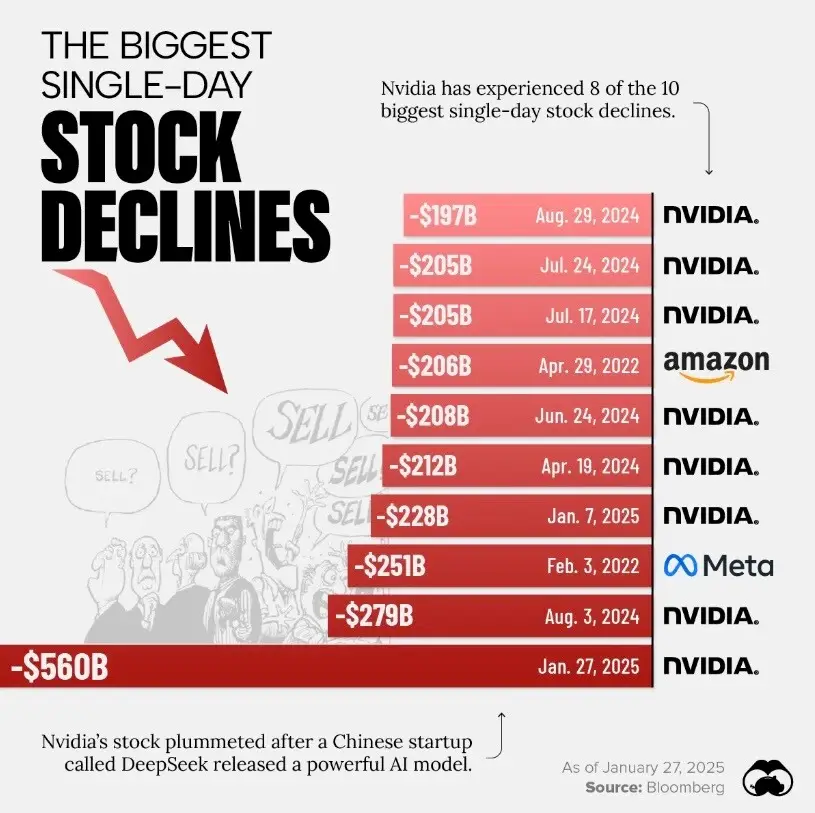

Biggest Market Drop in History?

At one point, the U.S. stock market was down $2.5 trillion that day.

The world’s 500 richest billionaires saw $108 billion disappear from their net worth.

Nvidia’s CEO, Jensen Huang, alone lost $20 billion.

But just like that, the very next day, a massive recovery rally took place.

Investors were reminded of Jevons’ paradox—the idea that technological progress often fuels more demand, not less—a key driver of capitalism since the Industrial Revolution.

Markets can be volatile, but history shows they tend to bounce back. Stay the course.

#StockMarket #Nvidia #Investing #MarketCrash #WealthBuilding

-

Kerim Tulun, CFP®

Share:

RELATED Posts

Tired of Living Paycheck to Paycheck? Change this now

Since 1980, the S&P 500 has averaged a correction (a drop of 10% or more) nearly every 1–2 years.

The Harsh Truth About the Stock Market

Since 1980, the S&P 500 has averaged a correction (a drop of 10% or more) nearly every 1–2 years.

TRUMP’S TARIFFS ARE IN : Should you sell stocks?

Trump’s Tariffs are in: Should you sell stocks? Short answer: No.