Financial Insights

Tired of Living Paycheck to Paycheck? Change this now

Since 1980, the S&P 500 has averaged a correction (a drop of 10% or more) nearly every 1–2 years.

The Harsh Truth About the Stock Market

Since 1980, the S&P 500 has averaged a correction (a drop of 10% or more) nearly every 1–2 years.

TRUMP’S TARIFFS ARE IN : Should you sell stocks?

Trump’s Tariffs are in: Should you sell stocks? Short answer: No.

Minimize Taxes in Retirement

Want to pay less in taxes during retirement? Consider skipping traditional 401(k) or IRA contributions and go Roth instead.

Earn too much for a Roth IRA?

There’s still a way in- it’s called a Backdoor Roth IRA contribution.

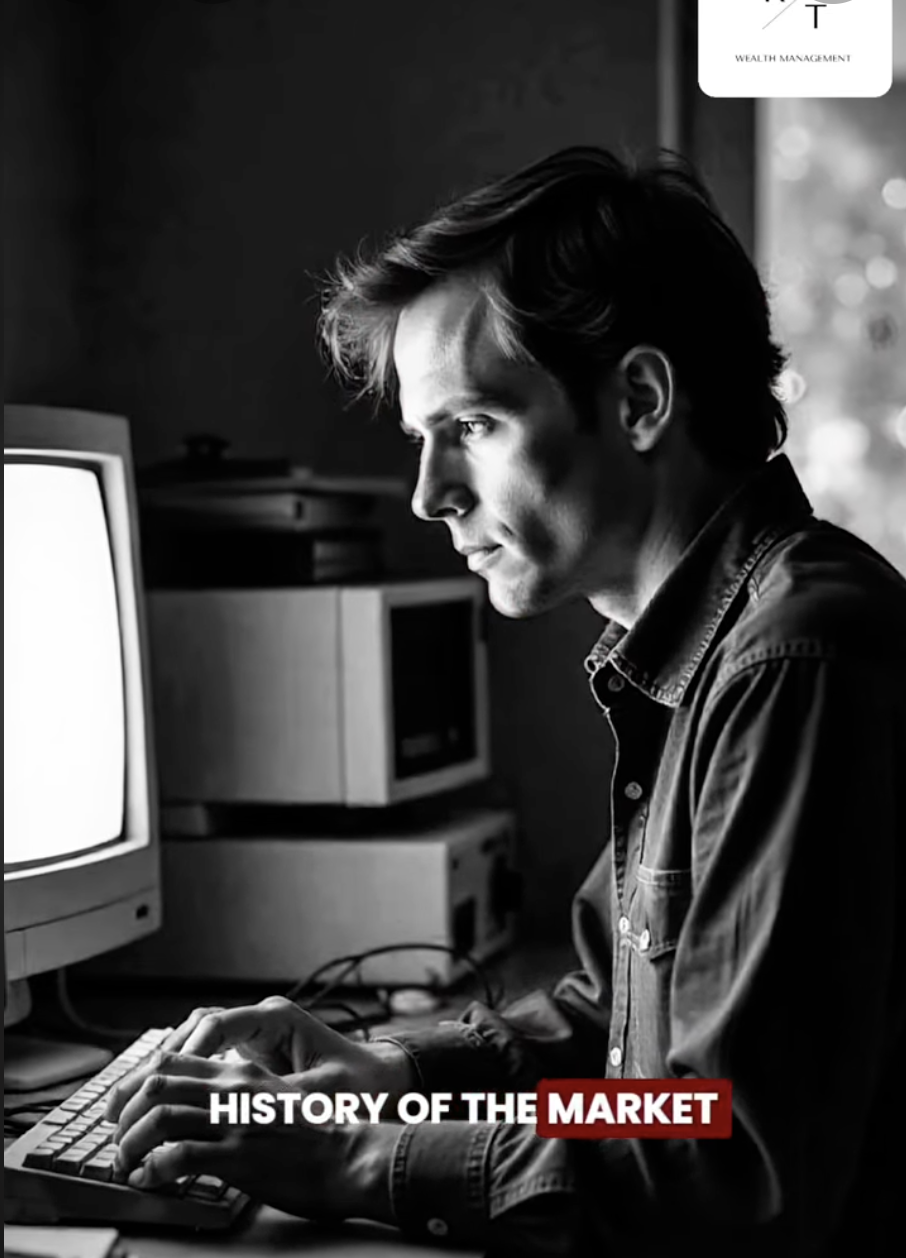

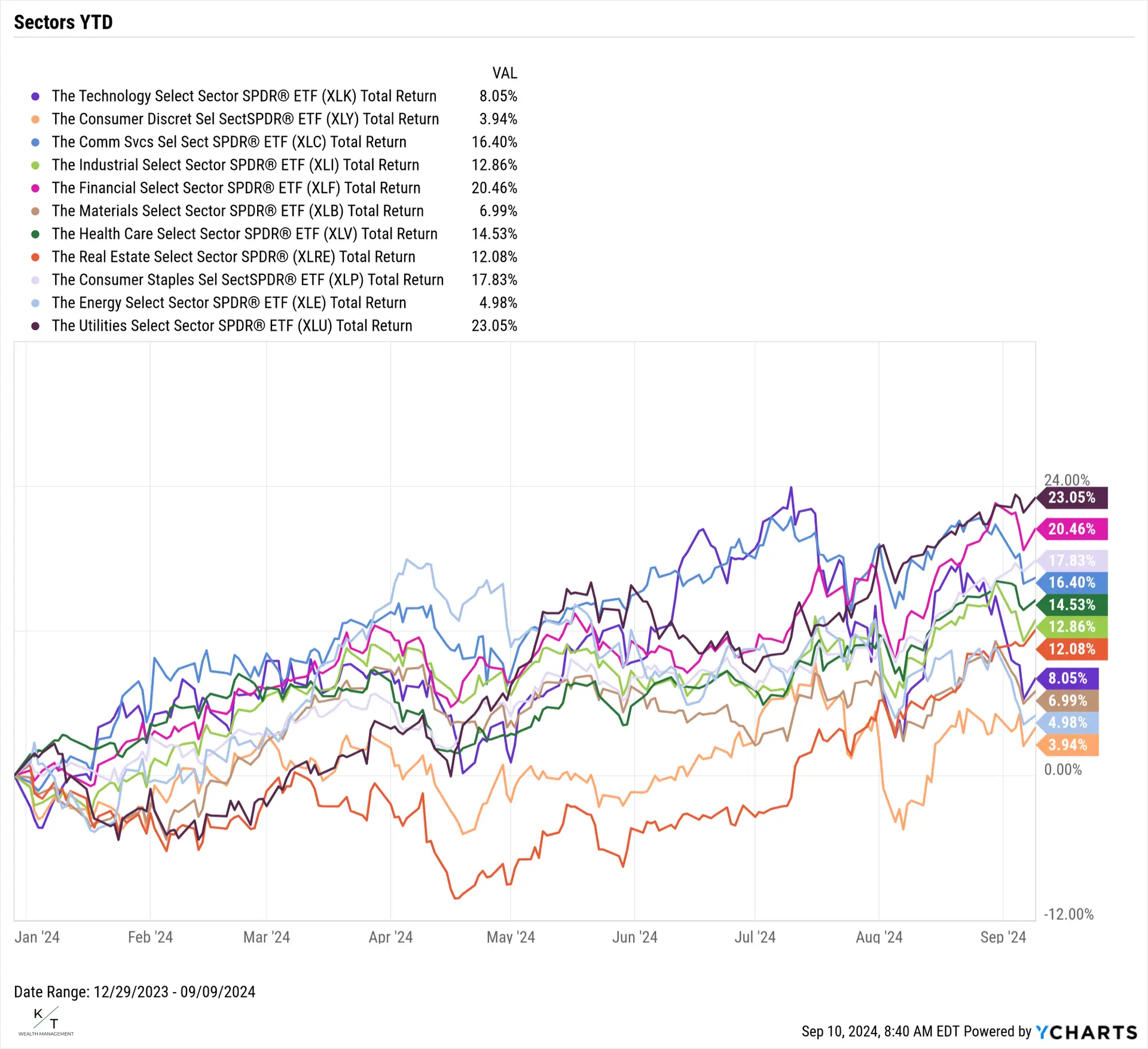

Is Market Leadership Shifting?

A shift is underway in market leadership—are you paying attention?

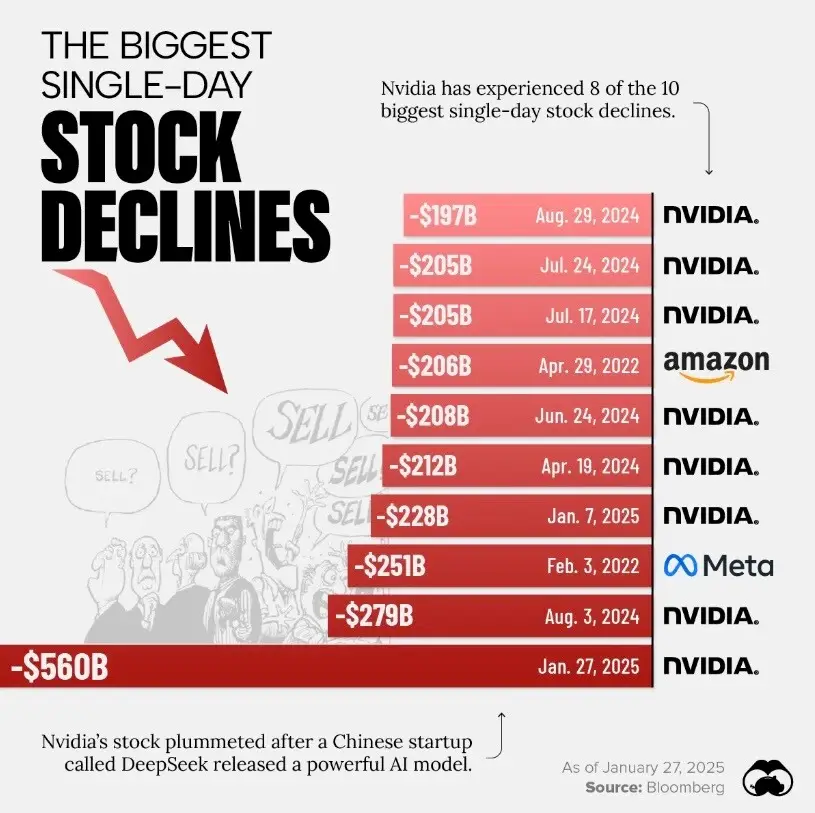

Biggest Market Drop in History?

In one day, Nvidia (NVDA) lost nearly $600 billion in market value—more than the entire worth of Mastercard.

The Rule Of 72: The simple math behind doubling your money.

The Rule of 72 is a simple, powerful formula that can help you estimate your investment growth.

Utilities Surge in 2024: A Surprising Market Leader Turnaround

Utilities have surged 23% in 2024, marking a stunning turnaround from 2023 and reclaiming market leadership last seen in 2018.

![ycharts SPY performance throughout presidencies {"type":"elementor","siteurl":"https://ktwealthmanagement.com/wp-json/","elements":[{"id":"401559c","elType":"widget","isInner":false,"isLocked":false,"settings":{"__dynamic__":{"image":"[elementor-tag id=\"\" name=\"post-featured-image\" settings=\"%7B%22fallback%22%3A%7B%22url%22%3A%22%22%2C%22id%22%3A%22%22%7D%7D\"]"},"image_size":"full","width":{"unit":"%","size":80,"sizes":[]},"_margin":{"unit":"px","top":"50","right":"0","bottom":"0","left":"0","isLinked":""},"image":{"id":764,"url":"https://ktwealthmanagement.com/wp-content/uploads/2024/06/placeholder-1-1.png"},"element_pack_cursor_effects_image_src":{"id":765,"url":"https://ktwealthmanagement.com/wp-content/uploads/2024/06/placeholder-61.png"},"ep_notation_list":[{"_id":"6c54f87","ep_notation_bracket_on":"left,right","ep_notation_select_type":"widget","ep_notation_custom_selector":"","ep_notation_type":"underline","ep_notation_color":"","ep_notation_anim_duration":{"unit":"px","size":800,"sizes":[]},"ep_notation_stroke_width":{"unit":"px","size":1,"sizes":[]},"ep_notation_waypoint_offset":""}],"ep_sound_effects_hosted_url":{"id":"","url":"https://ktwealthmanagement.com/wp-content/plugins/elementor/assets/images/placeholder.png"},"ep_display_conditions":[],"ep_widget_cf_colors":"#D30C5C, #0EBCDC, #EAED41, #ED5A78, #DF33DF","ep_widget_cf_shapes":"square|circle","ep_widget_cf_shapes_emoji":"🎃|🎄|💜","ep_widget_cf_shapes_svg":"M167 72c19,-38 37,-56 75,-56 42,0 76,33 76,75 0,76 -76,151 -151,227 -76,-76 -151,-151 -151,-227 0,-42 33,-75 75,-75 38,0 57,18 76,56z|M120 240c-41,14 -91,18 -120,1 29,-10 57,-22 81,-40 -18,2 -37,3 -55,-3 25,-14 48,-30 66,-51 -11,5 -26,8 -45,7 20,-14 40,-30 57,-49 -13,1 -26,2 -38,-1 18,-11 35,-25 51,-43 -13,3 -24,5 -35,6 21,-19 40,-41 53,-67 14,26 32,48 54,67 -11,-1 -23,-3 -35,-6 15,18 32,32 51,43 -13,3 -26,2 -38,1 17,19 36,35 56,49 -19,1 -33,-2 -45,-7 19,21 42,37 67,51 -19,6 -37,5 -56,3 25,18 53,30 82,40 -30,17 -79,13 -120,-1l0 41 -31 0 0 -41z|M449.4 142c-5 0-10 .3-15 1a183 183 0 0 0-66.9-19.1V87.5a17.5 17.5 0 1 0-35 0v36.4a183 183 0 0 0-67 19c-4.9-.6-9.9-1-14.8-1C170.3 142 105 219.6 105 315s65.3 173 145.7 173c5 0 10-.3 14.8-1a184.7 184.7 0 0 0 169 0c4.9.7 9.9 1 14.9 1 80.3 0 145.6-77.6 145.6-173s-65.3-173-145.7-173zm-220 138 27.4-40.4a11.6 11.6 0 0 1 16.4-2.7l54.7 40.3a11.3 11.3 0 0 1-7 20.3H239a11.3 11.3 0 0 1-9.6-17.5zM444 383.8l-43.7 17.5a17.7 17.7 0 0 1-13 0l-37.3-15-37.2 15a17.8 17.8 0 0 1-13 0L256 383.8a17.5 17.5 0 0 1 13-32.6l37.3 15 37.2-15c4.2-1.6 8.8-1.6 13 0l37.3 15 37.2-15a17.5 17.5 0 0 1 13 32.6zm17-86.3h-82a11.3 11.3 0 0 1-6.9-20.4l54.7-40.3a11.6 11.6 0 0 1 16.4 2.8l27.4 40.4a11.3 11.3 0 0 1-9.6 17.5z","ep_sound_effects_element_selector":"my-header","element_pack_widget_tooltip_text":"This is Tooltip","ep_parallax_effects_transition_for":"all","ep_parallax_effects_transition_duration":"100","ep_parallax_effects_transition_easing":"linear","element_pack_widget_effect_transition_duration":"300","element_pack_widget_effect_transition_easing":"ease-out","image_custom_dimension":{"width":"","height":""},"caption_source":"none","caption":"","link_to":"none","link":{"url":"","is_external":"","nofollow":"","custom_attributes":""},"open_lightbox":"default","align":"","align_tablet":"","align_mobile":"","width_tablet":{"unit":"%","size":"","sizes":[]},"width_mobile":{"unit":"%","size":"","sizes":[]},"space":{"unit":"%","size":"","sizes":[]},"space_tablet":{"unit":"%","size":"","sizes":[]},"space_mobile":{"unit":"%","size":"","sizes":[]},"height":{"unit":"px","size":"","sizes":[]},"height_tablet":{"unit":"px","size":"","sizes":[]},"height_mobile":{"unit":"px","size":"","sizes":[]},"object-fit":"","object-fit_tablet":"","object-fit_mobile":"","object-position":"center center","object-position_tablet":"","object-position_mobile":"","opacity":{"unit":"px","size":"","sizes":[]},"css_filters_css_filter":"","css_filters_blur":{"unit":"px","size":0,"sizes":[]},"css_filters_brightness":{"unit":"px","size":100,"sizes":[]},"css_filters_contrast":{"unit":"px","size":100,"sizes":[]},"css_filters_saturate":{"unit":"px","size":100,"sizes":[]},"css_filters_hue":{"unit":"px","size":0,"sizes":[]},"opacity_hover":{"unit":"px","size":"","sizes":[]},"css_filters_hover_css_filter":"","css_filters_hover_blur":{"unit":"px","size":0,"sizes":[]},"css_filters_hover_brightness":{"unit":"px","size":100,"sizes":[]},"css_filters_hover_contrast":{"unit":"px","size":100,"sizes":[]},"css_filters_hover_saturate":{"unit":"px","size":100,"sizes":[]},"css_filters_hover_hue":{"unit":"px","size":0,"sizes":[]},"background_hover_transition":{"unit":"px","size":"","sizes":[]},"hover_animation":"","image_border_border":"","image_border_width":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"image_border_width_tablet":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"image_border_width_mobile":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"image_border_color":"","image_border_radius":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"image_border_radius_tablet":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"image_border_radius_mobile":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"image_box_shadow_box_shadow_type":"","image_box_shadow_box_shadow":{"horizontal":0,"vertical":0,"blur":10,"spread":0,"color":"rgba(0,0,0,0.5)"},"caption_align":"","caption_align_tablet":"","caption_align_mobile":"","text_color":"","caption_background_color":"","caption_typography_typography":"","caption_typography_font_family":"","caption_typography_font_size":{"unit":"px","size":"","sizes":[]},"caption_typography_font_size_tablet":{"unit":"px","size":"","sizes":[]},"caption_typography_font_size_mobile":{"unit":"px","size":"","sizes":[]},"caption_typography_font_weight":"","caption_typography_text_transform":"","caption_typography_font_style":"","caption_typography_text_decoration":"","caption_typography_line_height":{"unit":"px","size":"","sizes":[]},"caption_typography_line_height_tablet":{"unit":"em","size":"","sizes":[]},"caption_typography_line_height_mobile":{"unit":"em","size":"","sizes":[]},"caption_typography_letter_spacing":{"unit":"px","size":"","sizes":[]},"caption_typography_letter_spacing_tablet":{"unit":"px","size":"","sizes":[]},"caption_typography_letter_spacing_mobile":{"unit":"px","size":"","sizes":[]},"caption_typography_word_spacing":{"unit":"px","size":"","sizes":[]},"caption_typography_word_spacing_tablet":{"unit":"em","size":"","sizes":[]},"caption_typography_word_spacing_mobile":{"unit":"em","size":"","sizes":[]},"caption_text_shadow_text_shadow_type":"","caption_text_shadow_text_shadow":{"horizontal":0,"vertical":0,"blur":10,"color":"rgba(0,0,0,0.3)"},"caption_space":{"unit":"px","size":"","sizes":[]},"caption_space_tablet":{"unit":"px","size":"","sizes":[]},"caption_space_mobile":{"unit":"px","size":"","sizes":[]},"_title":"","_margin_tablet":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_margin_mobile":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_padding":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_padding_tablet":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_padding_mobile":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_element_width":"","_element_width_tablet":"","_element_width_mobile":"","_element_custom_width":{"unit":"%","size":"","sizes":[]},"_element_custom_width_tablet":{"unit":"px","size":"","sizes":[]},"_element_custom_width_mobile":{"unit":"px","size":"","sizes":[]},"_flex_align_self":"","_flex_align_self_tablet":"","_flex_align_self_mobile":"","_flex_order":"","_flex_order_tablet":"","_flex_order_mobile":"","_flex_order_custom":"","_flex_order_custom_tablet":"","_flex_order_custom_mobile":"","_flex_size":"","_flex_size_tablet":"","_flex_size_mobile":"","_flex_grow":1,"_flex_grow_tablet":"","_flex_grow_mobile":"","_flex_shrink":1,"_flex_shrink_tablet":"","_flex_shrink_mobile":"","_element_vertical_align":"","_element_vertical_align_tablet":"","_element_vertical_align_mobile":"","_position":"","_offset_orientation_h":"start","_offset_x":{"unit":"px","size":0,"sizes":[]},"_offset_x_tablet":{"unit":"px","size":"","sizes":[]},"_offset_x_mobile":{"unit":"px","size":"","sizes":[]},"_offset_x_end":{"unit":"px","size":0,"sizes":[]},"_offset_x_end_tablet":{"unit":"px","size":"","sizes":[]},"_offset_x_end_mobile":{"unit":"px","size":"","sizes":[]},"_offset_orientation_v":"start","_offset_y":{"unit":"px","size":0,"sizes":[]},"_offset_y_tablet":{"unit":"px","size":"","sizes":[]},"_offset_y_mobile":{"unit":"px","size":"","sizes":[]},"_offset_y_end":{"unit":"px","size":0,"sizes":[]},"_offset_y_end_tablet":{"unit":"px","size":"","sizes":[]},"_offset_y_end_mobile":{"unit":"px","size":"","sizes":[]},"_z_index":"","_z_index_tablet":"","_z_index_mobile":"","_element_id":"","_css_classes":"","e_display_conditions":"","eael_wrapper_link_switch":"","eael_wrapper_link":{"url":"","is_external":"","nofollow":"","custom_attributes":""},"ep_widget_cf_confetti":"","ep_widget_cf_type":"basic","ep_widget_cf_fireworks_duration":{"unit":"px","size":"","sizes":[]},"ep_widget_cf_anim_infinite":"","ep_widget_cf_particle_count":{"unit":"px","size":"","sizes":[]},"ep_widget_cf_start_velocity":{"unit":"px","size":"","sizes":[]},"ep_widget_cf_spread":{"unit":"px","size":"","sizes":[]},"ep_widget_cf_angle":{"unit":"px","size":"","sizes":[]},"ep_widget_cf_shape_type":"basic","ep_widget_cf_scalar":{"unit":"px","size":"","sizes":[]},"ep_widget_cf_origin":"","ep_widget_cf_origin_x":{"unit":"px","size":"","sizes":[]},"ep_widget_cf_origin_y":{"unit":"px","size":"","sizes":[]},"ep_widget_cf_trigger_type":"load","ep_widget_cf_trigger_selector":"","ep_widget_cf_trigger_delay":{"unit":"px","size":3000,"sizes":[]},"ep_widget_cf_z_index":"","element_pack_cursor_effects_show":"","element_pack_cursor_effects_source":"default","element_pack_cursor_effects_icons":{"value":"fas fa-laugh-wink","library":"fa-solid"},"element_pack_cursor_effects_style":"ep-cursor-style-1","element_pack_cursor_effects_text_label":"","element_pack_cursor_effects_speed":{"unit":"px","size":0.075,"sizes":[]},"element_pack_cursor_effects_disable_default_cursor":"","element_pack_cursor_effects_primary_color":"","element_pack_cursor_effects_primary_size":{"unit":"px","size":"","sizes":[]},"element_pack_cursor_effects_primary_size_tablet":{"unit":"px","size":"","sizes":[]},"element_pack_cursor_effects_primary_size_mobile":{"unit":"px","size":"","sizes":[]},"element_pack_cursor_effects_secondary_color":"","element_pack_cursor_effects_secondary_size":{"unit":"px","size":"","sizes":[]},"element_pack_cursor_effects_secondary_size_tablet":{"unit":"px","size":"","sizes":[]},"element_pack_cursor_effects_secondary_size_mobile":{"unit":"px","size":"","sizes":[]},"element_pack_cursor_effects_text_color":"","element_pack_cursor_effects_text_background_background":"","element_pack_cursor_effects_text_background_color":"","element_pack_cursor_effects_text_background_color_stop":{"unit":"%","size":0,"sizes":[]},"element_pack_cursor_effects_text_background_color_stop_tablet":{"unit":"%"},"element_pack_cursor_effects_text_background_color_stop_mobile":{"unit":"%"},"element_pack_cursor_effects_text_background_color_b":"#f2295b","element_pack_cursor_effects_text_background_color_b_stop":{"unit":"%","size":100,"sizes":[]},"element_pack_cursor_effects_text_background_color_b_stop_tablet":{"unit":"%"},"element_pack_cursor_effects_text_background_color_b_stop_mobile":{"unit":"%"},"element_pack_cursor_effects_text_background_gradient_type":"linear","element_pack_cursor_effects_text_background_gradient_angle":{"unit":"deg","size":180,"sizes":[]},"element_pack_cursor_effects_text_background_gradient_angle_tablet":{"unit":"deg"},"element_pack_cursor_effects_text_background_gradient_angle_mobile":{"unit":"deg"},"element_pack_cursor_effects_text_background_gradient_position":"center center","element_pack_cursor_effects_text_background_gradient_position_tablet":"","element_pack_cursor_effects_text_background_gradient_position_mobile":"","element_pack_cursor_effects_text_background_image":{"url":"","id":"","size":""},"element_pack_cursor_effects_text_background_image_tablet":{"url":"","id":"","size":""},"element_pack_cursor_effects_text_background_image_mobile":{"url":"","id":"","size":""},"element_pack_cursor_effects_text_background_position":"","element_pack_cursor_effects_text_background_position_tablet":"","element_pack_cursor_effects_text_background_position_mobile":"","element_pack_cursor_effects_text_background_xpos":{"unit":"px","size":0,"sizes":[]},"element_pack_cursor_effects_text_background_xpos_tablet":{"unit":"px","size":0,"sizes":[]},"element_pack_cursor_effects_text_background_xpos_mobile":{"unit":"px","size":0,"sizes":[]},"element_pack_cursor_effects_text_background_ypos":{"unit":"px","size":0,"sizes":[]},"element_pack_cursor_effects_text_background_ypos_tablet":{"unit":"px","size":0,"sizes":[]},"element_pack_cursor_effects_text_background_ypos_mobile":{"unit":"px","size":0,"sizes":[]},"element_pack_cursor_effects_text_background_attachment":"","element_pack_cursor_effects_text_background_repeat":"","element_pack_cursor_effects_text_background_repeat_tablet":"","element_pack_cursor_effects_text_background_repeat_mobile":"","element_pack_cursor_effects_text_background_size":"","element_pack_cursor_effects_text_background_size_tablet":"","element_pack_cursor_effects_text_background_size_mobile":"","element_pack_cursor_effects_text_background_bg_width":{"unit":"%","size":100,"sizes":[]},"element_pack_cursor_effects_text_background_bg_width_tablet":{"unit":"px","size":"","sizes":[]},"element_pack_cursor_effects_text_background_bg_width_mobile":{"unit":"px","size":"","sizes":[]},"element_pack_cursor_effects_text_background_video_link":"","element_pack_cursor_effects_text_background_video_start":"","element_pack_cursor_effects_text_background_video_end":"","element_pack_cursor_effects_text_background_play_once":"","element_pack_cursor_effects_text_background_play_on_mobile":"","element_pack_cursor_effects_text_background_privacy_mode":"","element_pack_cursor_effects_text_background_video_fallback":{"url":"","id":"","size":""},"element_pack_cursor_effects_text_background_slideshow_gallery":[],"element_pack_cursor_effects_text_background_slideshow_loop":"yes","element_pack_cursor_effects_text_background_slideshow_slide_duration":5000,"element_pack_cursor_effects_text_background_slideshow_slide_transition":"fade","element_pack_cursor_effects_text_background_slideshow_transition_duration":500,"element_pack_cursor_effects_text_background_slideshow_background_size":"","element_pack_cursor_effects_text_background_slideshow_background_size_tablet":"","element_pack_cursor_effects_text_background_slideshow_background_size_mobile":"","element_pack_cursor_effects_text_background_slideshow_background_position":"","element_pack_cursor_effects_text_background_slideshow_background_position_tablet":"","element_pack_cursor_effects_text_background_slideshow_background_position_mobile":"","element_pack_cursor_effects_text_background_slideshow_lazyload":"","element_pack_cursor_effects_text_background_slideshow_ken_burns":"","element_pack_cursor_effects_text_background_slideshow_ken_burns_zoom_direction":"in","element_pack_cursor_effects_text_padding":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"element_pack_cursor_effects_text_padding_tablet":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"element_pack_cursor_effects_text_padding_mobile":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"element_pack_cursor_effects_text_border_border":"","element_pack_cursor_effects_text_border_width":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"element_pack_cursor_effects_text_border_width_tablet":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"element_pack_cursor_effects_text_border_width_mobile":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"element_pack_cursor_effects_text_border_color":"","element_pack_cursor_effects_text_radius":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"element_pack_cursor_effects_text_radius_tablet":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"element_pack_cursor_effects_text_radius_mobile":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"element_pack_cursor_effects_text_typography_typography":"","element_pack_cursor_effects_text_typography_font_family":"","element_pack_cursor_effects_text_typography_font_size":{"unit":"px","size":"","sizes":[]},"element_pack_cursor_effects_text_typography_font_size_tablet":{"unit":"px","size":"","sizes":[]},"element_pack_cursor_effects_text_typography_font_size_mobile":{"unit":"px","size":"","sizes":[]},"element_pack_cursor_effects_text_typography_font_weight":"","element_pack_cursor_effects_text_typography_text_transform":"","element_pack_cursor_effects_text_typography_font_style":"","element_pack_cursor_effects_text_typography_text_decoration":"","element_pack_cursor_effects_text_typography_line_height":{"unit":"px","size":"","sizes":[]},"element_pack_cursor_effects_text_typography_line_height_tablet":{"unit":"em","size":"","sizes":[]},"element_pack_cursor_effects_text_typography_line_height_mobile":{"unit":"em","size":"","sizes":[]},"element_pack_cursor_effects_text_typography_letter_spacing":{"unit":"px","size":"","sizes":[]},"element_pack_cursor_effects_text_typography_letter_spacing_tablet":{"unit":"px","size":"","sizes":[]},"element_pack_cursor_effects_text_typography_letter_spacing_mobile":{"unit":"px","size":"","sizes":[]},"element_pack_cursor_effects_text_typography_word_spacing":{"unit":"px","size":"","sizes":[]},"element_pack_cursor_effects_text_typography_word_spacing_tablet":{"unit":"em","size":"","sizes":[]},"element_pack_cursor_effects_text_typography_word_spacing_mobile":{"unit":"em","size":"","sizes":[]},"element_pack_cursor_effects_image_size":{"unit":"px","size":"","sizes":[]},"element_pack_cursor_effects_image_size_tablet":{"unit":"px","size":"","sizes":[]},"element_pack_cursor_effects_image_size_mobile":{"unit":"px","size":"","sizes":[]},"element_pack_cursor_effects_image_border_border":"","element_pack_cursor_effects_image_border_width":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"element_pack_cursor_effects_image_border_width_tablet":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"element_pack_cursor_effects_image_border_width_mobile":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"element_pack_cursor_effects_image_border_color":"","element_pack_cursor_effects_image_radius":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"element_pack_cursor_effects_image_radius_tablet":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"element_pack_cursor_effects_image_radius_mobile":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"element_pack_cursor_effects_icons_size":{"unit":"px","size":"","sizes":[]},"element_pack_cursor_effects_icons_size_tablet":{"unit":"px","size":"","sizes":[]},"element_pack_cursor_effects_icons_size_mobile":{"unit":"px","size":"","sizes":[]},"ep_notation_active":"","element_pack_reveal_effects_enable":"","element_pack_reveal_effects_direction":"lr","element_pack_reveal_effects_easing":"easeOutQuint","element_pack_reveal_effects_speed":{"unit":"px","size":5,"sizes":[]},"element_pack_reveal_effects_color":"","ep_sound_effects_active":"","ep_sound_effects_select_type":"widget","ep_sound_effects_event":"click","ep_sound_effects_source":"bubble","ep_sound_effects_source_local_link":"https://ktwealthmanagement.com/wp-content/plugins/bdthemes-element-pack/assets/sounds/","ep_sound_effects_hosted_url_mp3":{"url":"","id":"","size":""},"element_pack_widget_tooltip":"","element_pack_widget_tooltip_placement":"","element_pack_widget_tooltip_follow_cursor":"","element_pack_widget_tooltip_animation":"","element_pack_widget_tooltip_trigger":"","element_pack_widget_tooltip_custom_trigger":"","element_pack_widget_tooltip_x_offset":{"unit":"px","size":"","sizes":[]},"element_pack_widget_tooltip_y_offset":{"unit":"px","size":"","sizes":[]},"element_pack_widget_tooltip_arrow":"","element_pack_widget_tooltip_width":{"unit":"px","size":"","sizes":[]},"element_pack_widget_tooltip_width_tablet":{"unit":"px","size":"","sizes":[]},"element_pack_widget_tooltip_width_mobile":{"unit":"px","size":"","sizes":[]},"element_pack_widget_tooltip_color":"","element_pack_widget_tooltip_background_background":"","element_pack_widget_tooltip_background_color":"","element_pack_widget_tooltip_background_color_stop":{"unit":"%","size":0,"sizes":[]},"element_pack_widget_tooltip_background_color_stop_tablet":{"unit":"%"},"element_pack_widget_tooltip_background_color_stop_mobile":{"unit":"%"},"element_pack_widget_tooltip_background_color_b":"#f2295b","element_pack_widget_tooltip_background_color_b_stop":{"unit":"%","size":100,"sizes":[]},"element_pack_widget_tooltip_background_color_b_stop_tablet":{"unit":"%"},"element_pack_widget_tooltip_background_color_b_stop_mobile":{"unit":"%"},"element_pack_widget_tooltip_background_gradient_type":"linear","element_pack_widget_tooltip_background_gradient_angle":{"unit":"deg","size":180,"sizes":[]},"element_pack_widget_tooltip_background_gradient_angle_tablet":{"unit":"deg"},"element_pack_widget_tooltip_background_gradient_angle_mobile":{"unit":"deg"},"element_pack_widget_tooltip_background_gradient_position":"center center","element_pack_widget_tooltip_background_gradient_position_tablet":"","element_pack_widget_tooltip_background_gradient_position_mobile":"","element_pack_widget_tooltip_background_image":{"url":"","id":"","size":""},"element_pack_widget_tooltip_background_image_tablet":{"url":"","id":"","size":""},"element_pack_widget_tooltip_background_image_mobile":{"url":"","id":"","size":""},"element_pack_widget_tooltip_background_position":"","element_pack_widget_tooltip_background_position_tablet":"","element_pack_widget_tooltip_background_position_mobile":"","element_pack_widget_tooltip_background_xpos":{"unit":"px","size":0,"sizes":[]},"element_pack_widget_tooltip_background_xpos_tablet":{"unit":"px","size":0,"sizes":[]},"element_pack_widget_tooltip_background_xpos_mobile":{"unit":"px","size":0,"sizes":[]},"element_pack_widget_tooltip_background_ypos":{"unit":"px","size":0,"sizes":[]},"element_pack_widget_tooltip_background_ypos_tablet":{"unit":"px","size":0,"sizes":[]},"element_pack_widget_tooltip_background_ypos_mobile":{"unit":"px","size":0,"sizes":[]},"element_pack_widget_tooltip_background_attachment":"","element_pack_widget_tooltip_background_repeat":"","element_pack_widget_tooltip_background_repeat_tablet":"","element_pack_widget_tooltip_background_repeat_mobile":"","element_pack_widget_tooltip_background_size":"","element_pack_widget_tooltip_background_size_tablet":"","element_pack_widget_tooltip_background_size_mobile":"","element_pack_widget_tooltip_background_bg_width":{"unit":"%","size":100,"sizes":[]},"element_pack_widget_tooltip_background_bg_width_tablet":{"unit":"px","size":"","sizes":[]},"element_pack_widget_tooltip_background_bg_width_mobile":{"unit":"px","size":"","sizes":[]},"element_pack_widget_tooltip_background_video_link":"","element_pack_widget_tooltip_background_video_start":"","element_pack_widget_tooltip_background_video_end":"","element_pack_widget_tooltip_background_play_once":"","element_pack_widget_tooltip_background_play_on_mobile":"","element_pack_widget_tooltip_background_privacy_mode":"","element_pack_widget_tooltip_background_video_fallback":{"url":"","id":"","size":""},"element_pack_widget_tooltip_background_slideshow_gallery":[],"element_pack_widget_tooltip_background_slideshow_loop":"yes","element_pack_widget_tooltip_background_slideshow_slide_duration":5000,"element_pack_widget_tooltip_background_slideshow_slide_transition":"fade","element_pack_widget_tooltip_background_slideshow_transition_duration":500,"element_pack_widget_tooltip_background_slideshow_background_size":"","element_pack_widget_tooltip_background_slideshow_background_size_tablet":"","element_pack_widget_tooltip_background_slideshow_background_size_mobile":"","element_pack_widget_tooltip_background_slideshow_background_position":"","element_pack_widget_tooltip_background_slideshow_background_position_tablet":"","element_pack_widget_tooltip_background_slideshow_background_position_mobile":"","element_pack_widget_tooltip_background_slideshow_lazyload":"","element_pack_widget_tooltip_background_slideshow_ken_burns":"","element_pack_widget_tooltip_background_slideshow_ken_burns_zoom_direction":"in","element_pack_widget_tooltip_arrow_color":"","element_pack_widget_tooltip_padding":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"element_pack_widget_tooltip_padding_tablet":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"element_pack_widget_tooltip_padding_mobile":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"element_pack_widget_tooltip_border_border":"","element_pack_widget_tooltip_border_width":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"element_pack_widget_tooltip_border_width_tablet":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"element_pack_widget_tooltip_border_width_mobile":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"element_pack_widget_tooltip_border_color":"","element_pack_widget_tooltip_border_radius":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"element_pack_widget_tooltip_border_radius_tablet":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"element_pack_widget_tooltip_border_radius_mobile":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"element_pack_widget_tooltip_text_align":"center","element_pack_widget_tooltip_box_shadow_box_shadow_type":"","element_pack_widget_tooltip_box_shadow_box_shadow":{"horizontal":0,"vertical":0,"blur":10,"spread":0,"color":"rgba(0,0,0,0.5)"},"element_pack_widget_tooltip_box_shadow_box_shadow_position":" ","element_pack_widget_tooltip_typography_typography":"","element_pack_widget_tooltip_typography_font_family":"","element_pack_widget_tooltip_typography_font_size":{"unit":"px","size":"","sizes":[]},"element_pack_widget_tooltip_typography_font_size_tablet":{"unit":"px","size":"","sizes":[]},"element_pack_widget_tooltip_typography_font_size_mobile":{"unit":"px","size":"","sizes":[]},"element_pack_widget_tooltip_typography_font_weight":"","element_pack_widget_tooltip_typography_text_transform":"","element_pack_widget_tooltip_typography_font_style":"","element_pack_widget_tooltip_typography_text_decoration":"","element_pack_widget_tooltip_typography_line_height":{"unit":"px","size":"","sizes":[]},"element_pack_widget_tooltip_typography_line_height_tablet":{"unit":"em","size":"","sizes":[]},"element_pack_widget_tooltip_typography_line_height_mobile":{"unit":"em","size":"","sizes":[]},"element_pack_widget_tooltip_typography_letter_spacing":{"unit":"px","size":"","sizes":[]},"element_pack_widget_tooltip_typography_letter_spacing_tablet":{"unit":"px","size":"","sizes":[]},"element_pack_widget_tooltip_typography_letter_spacing_mobile":{"unit":"px","size":"","sizes":[]},"element_pack_widget_tooltip_typography_word_spacing":{"unit":"px","size":"","sizes":[]},"element_pack_widget_tooltip_typography_word_spacing_tablet":{"unit":"em","size":"","sizes":[]},"element_pack_widget_tooltip_typography_word_spacing_mobile":{"unit":"em","size":"","sizes":[]},"ep_display_conditions_enable":"","ep_display_conditions_to":"show","ep_display_conditions_relation":"all","element_pack_wrapper_link":{"url":"","is_external":"","nofollow":"","custom_attributes":""},"ep_floating_effects_show":"","ep_floating_effects_translate_toggle":"","ep_floating_effects_translate_x":{"unit":"px","size":"","sizes":{"from":0,"to":0}},"ep_floating_effects_translate_y":{"unit":"px","size":"","sizes":{"from":0,"to":30}},"ep_floating_effects_translate_duration":{"unit":"px","size":1000,"sizes":[]},"ep_floating_effects_translate_delay":{"unit":"px","size":"","sizes":[]},"ep_floating_effects_rotate_toggle":"","ep_floating_effects_rotate_x":{"unit":"deg","size":"","sizes":{"from":0,"to":0}},"ep_floating_effects_rotate_y":{"unit":"deg","size":"","sizes":{"from":0,"to":0}},"ep_floating_effects_rotate_z":{"unit":"deg","size":"","sizes":{"from":0,"to":45}},"ep_floating_effects_rotate_infinite":"","ep_floating_effects_rotate_duration":{"unit":"px","size":2000,"sizes":[]},"ep_floating_effects_rotate_delay":{"unit":"px","size":"","sizes":[]},"ep_floating_effects_scale_toggle":"","ep_floating_effects_scale_x":{"unit":"px","size":"","sizes":{"from":1,"to":1.5}},"ep_floating_effects_scale_y":{"unit":"px","size":"","sizes":{"from":1,"to":1.5}},"ep_floating_effects_scale_duration":{"unit":"px","size":1000,"sizes":[]},"ep_floating_effects_scale_delay":{"unit":"px","size":"","sizes":[]},"ep_floating_effects_skew_toggle":"","ep_floating_effects_skew_x":{"unit":"px","size":"","sizes":{"from":1,"to":1.5}},"ep_floating_effects_skew_y":{"unit":"px","size":"","sizes":{"from":1,"to":1.5}},"ep_floating_effects_skew_duration":{"unit":"px","size":1000,"sizes":[]},"ep_floating_effects_skew_delay":{"unit":"px","size":"","sizes":[]},"ep_floating_effects_border_radius_toggle":"","ep_floating_effects_border_radius":{"unit":"px","size":"","sizes":{"from":0,"to":50}},"ep_floating_effects_border_radius_duration":{"unit":"px","size":1000,"sizes":[]},"ep_floating_effects_border_radius_delay":{"unit":"px","size":"","sizes":[]},"ep_floating_effects_opacity_toggle":"","ep_floating_effects_opacity_start":{"unit":"px","size":1,"sizes":[]},"ep_floating_effects_opacity_end":{"unit":"px","size":0,"sizes":[]},"ep_floating_effects_opacity_duration":{"unit":"px","size":1000,"sizes":[]},"ep_floating_effects_easing":"easeInOutQuad","ep_parallax_effects_show":"","ep_parallax_effects_x":"","ep_parallax_effects_x_start":{"unit":"px","size":"","sizes":[]},"ep_parallax_effects_x_end":{"unit":"px","size":"","sizes":[]},"ep_parallax_effects_x_custom_show":"","ep_parallax_effects_x_custom_value":"","ep_parallax_effects_y":"","ep_parallax_effects_y_start":{"unit":"px","size":50,"sizes":[]},"ep_parallax_effects_y_end":{"unit":"px","size":0,"sizes":[]},"ep_parallax_effects_y_custom_show":"","ep_parallax_effects_y_custom_value":"","ep_parallax_effects_opacity_toggole":"","ep_parallax_effects_opacity":"","ep_parallax_effects_opacity_custom_show":"","ep_parallax_effects_opacity_custom_value":"","ep_parallax_effects_blur":"","ep_parallax_effects_blur_start":{"unit":"px","size":"","sizes":[]},"ep_parallax_effects_blur_end":{"unit":"px","size":"","sizes":[]},"ep_parallax_effects_rotate":"","ep_parallax_effects_rotate_start":{"unit":"px","size":"","sizes":[]},"ep_parallax_effects_rotate_end":{"unit":"px","size":"","sizes":[]},"ep_parallax_effects_scale":"","ep_parallax_effects_scale_start":{"unit":"px","size":1,"sizes":[]},"ep_parallax_effects_scale_end":{"unit":"px","size":1,"sizes":[]},"ep_parallax_effects_hue":"","ep_parallax_effects_hue_value":{"unit":"px","size":"","sizes":[]},"ep_parallax_effects_sepia":"","ep_parallax_effects_sepia_value":{"unit":"px","size":1,"sizes":[]},"ep_parallax_effects_easing":"","ep_parallax_effects_easing_value":{"unit":"px","size":1,"sizes":[]},"ep_parallax_effects_transition":"","ep_parallax_effects_viewport":"","ep_parallax_effects_viewport_start":"","ep_parallax_effects_viewport_end":"","ep_parallax_effects_media_query":"","ep_parallax_effects_target":"self","motion_fx_motion_fx_scrolling":"","motion_fx_translateY_effect":"","motion_fx_translateY_direction":"","motion_fx_translateY_speed":{"unit":"px","size":4,"sizes":[]},"motion_fx_translateY_affectedRange":{"unit":"%","size":"","sizes":{"start":0,"end":100}},"motion_fx_translateX_effect":"","motion_fx_translateX_direction":"","motion_fx_translateX_speed":{"unit":"px","size":4,"sizes":[]},"motion_fx_translateX_affectedRange":{"unit":"%","size":"","sizes":{"start":0,"end":100}},"motion_fx_opacity_effect":"","motion_fx_opacity_direction":"out-in","motion_fx_opacity_level":{"unit":"px","size":10,"sizes":[]},"motion_fx_opacity_range":{"unit":"%","size":"","sizes":{"start":20,"end":80}},"motion_fx_blur_effect":"","motion_fx_blur_direction":"out-in","motion_fx_blur_level":{"unit":"px","size":7,"sizes":[]},"motion_fx_blur_range":{"unit":"%","size":"","sizes":{"start":20,"end":80}},"motion_fx_rotateZ_effect":"","motion_fx_rotateZ_direction":"","motion_fx_rotateZ_speed":{"unit":"px","size":1,"sizes":[]},"motion_fx_rotateZ_affectedRange":{"unit":"%","size":"","sizes":{"start":0,"end":100}},"motion_fx_scale_effect":"","motion_fx_scale_direction":"out-in","motion_fx_scale_speed":{"unit":"px","size":4,"sizes":[]},"motion_fx_scale_range":{"unit":"%","size":"","sizes":{"start":20,"end":80}},"motion_fx_transform_origin_x":"center","motion_fx_transform_origin_y":"center","motion_fx_devices":["desktop","tablet","mobile"],"motion_fx_range":"","motion_fx_motion_fx_mouse":"","motion_fx_mouseTrack_effect":"","motion_fx_mouseTrack_direction":"","motion_fx_mouseTrack_speed":{"unit":"px","size":1,"sizes":[]},"motion_fx_tilt_effect":"","motion_fx_tilt_direction":"","motion_fx_tilt_speed":{"unit":"px","size":4,"sizes":[]},"sticky":"","sticky_on":["desktop","tablet","mobile"],"sticky_offset":0,"sticky_offset_tablet":"","sticky_offset_mobile":"","sticky_effects_offset":0,"sticky_effects_offset_tablet":"","sticky_effects_offset_mobile":"","sticky_parent":"","_animation":"","_animation_tablet":"","_animation_mobile":"","animation_duration":"","_animation_delay":"","element_pack_widget_transform":"","element_pack_translate_toggle_normal":"","element_pack_widget_effect_transx_normal":{"unit":"px","size":"","sizes":[]},"element_pack_widget_effect_transx_normal_tablet":{"unit":"px","size":"","sizes":[]},"element_pack_widget_effect_transx_normal_mobile":{"unit":"px","size":"","sizes":[]},"element_pack_widget_effect_transy_normal":{"unit":"px","size":"","sizes":[]},"element_pack_widget_effect_transy_normal_tablet":{"unit":"px","size":"","sizes":[]},"element_pack_widget_effect_transy_normal_mobile":{"unit":"px","size":"","sizes":[]},"element_pack_rotate_toggle_normal":"","element_pack_widget_effect_rotatex_normal":{"unit":"px","size":"","sizes":[]},"element_pack_widget_effect_rotatex_normal_tablet":{"unit":"px","size":"","sizes":[]},"element_pack_widget_effect_rotatex_normal_mobile":{"unit":"px","size":"","sizes":[]},"element_pack_widget_effect_rotatey_normal":{"unit":"px","size":"","sizes":[]},"element_pack_widget_effect_rotatey_normal_tablet":{"unit":"px","size":"","sizes":[]},"element_pack_widget_effect_rotatey_normal_mobile":{"unit":"px","size":"","sizes":[]},"element_pack_widget_effect_rotatez_normal":{"unit":"px","size":"","sizes":[]},"element_pack_widget_effect_rotatez_normal_tablet":{"unit":"px","size":"","sizes":[]},"element_pack_widget_effect_rotatez_normal_mobile":{"unit":"px","size":"","sizes":[]},"element_pack_scale_normal":"","element_pack_widget_effect_scalex_normal":{"unit":"px","size":"","sizes":[]},"element_pack_widget_effect_scalex_normal_tablet":{"unit":"px","size":"","sizes":[]},"element_pack_widget_effect_scalex_normal_mobile":{"unit":"px","size":"","sizes":[]},"element_pack_widget_effect_scaley_normal":{"unit":"px","size":"","sizes":[]},"element_pack_widget_effect_scaley_normal_tablet":{"unit":"px","size":"","sizes":[]},"element_pack_widget_effect_scaley_normal_mobile":{"unit":"px","size":"","sizes":[]},"element_pack_skew_normal":"","element_pack_widget_effect_skewx_normal":{"unit":"px","size":"","sizes":[]},"element_pack_widget_effect_skewx_normal_tablet":{"unit":"px","size":"","sizes":[]},"element_pack_widget_effect_skewx_normal_mobile":{"unit":"px","size":"","sizes":[]},"element_pack_widget_effect_skewy_normal":{"unit":"px","size":"","sizes":[]},"element_pack_widget_effect_skewy_normal_tablet":{"unit":"px","size":"","sizes":[]},"element_pack_widget_effect_skewy_normal_mobile":{"unit":"px","size":"","sizes":[]},"element_pack_translate_toggle_hover":"","element_pack_widget_effect_transx_hover":{"unit":"px","size":"","sizes":[]},"element_pack_widget_effect_transx_hover_tablet":{"unit":"px","size":"","sizes":[]},"element_pack_widget_effect_transx_hover_mobile":{"unit":"px","size":"","sizes":[]},"element_pack_widget_effect_transy_hover":{"unit":"px","size":"","sizes":[]},"element_pack_widget_effect_transy_hover_tablet":{"unit":"px","size":"","sizes":[]},"element_pack_widget_effect_transy_hover_mobile":{"unit":"px","size":"","sizes":[]},"element_pack_rotate_toggle_hover":"","element_pack_widget_effect_rotatex_hover":{"unit":"px","size":"","sizes":[]},"element_pack_widget_effect_rotatex_hover_tablet":{"unit":"px","size":"","sizes":[]},"element_pack_widget_effect_rotatex_hover_mobile":{"unit":"px","size":"","sizes":[]},"element_pack_widget_effect_rotatey_hover":{"unit":"px","size":"","sizes":[]},"element_pack_widget_effect_rotatey_hover_tablet":{"unit":"px","size":"","sizes":[]},"element_pack_widget_effect_rotatey_hover_mobile":{"unit":"px","size":"","sizes":[]},"element_pack_widget_effect_rotatez_hover":{"unit":"px","size":"","sizes":[]},"element_pack_widget_effect_rotatez_hover_tablet":{"unit":"px","size":"","sizes":[]},"element_pack_widget_effect_rotatez_hover_mobile":{"unit":"px","size":"","sizes":[]},"element_pack_scale_hover":"","element_pack_widget_effect_scalex_hover":{"unit":"px","size":"","sizes":[]},"element_pack_widget_effect_scalex_hover_tablet":{"unit":"px","size":"","sizes":[]},"element_pack_widget_effect_scalex_hover_mobile":{"unit":"px","size":"","sizes":[]},"element_pack_widget_effect_scaley_hover":{"unit":"px","size":"","sizes":[]},"element_pack_widget_effect_scaley_hover_tablet":{"unit":"px","size":"","sizes":[]},"element_pack_widget_effect_scaley_hover_mobile":{"unit":"px","size":"","sizes":[]},"element_pack_skew_hover":"","element_pack_widget_effect_skewx_hover":{"unit":"px","size":"","sizes":[]},"element_pack_widget_effect_skewx_hover_tablet":{"unit":"px","size":"","sizes":[]},"element_pack_widget_effect_skewx_hover_mobile":{"unit":"px","size":"","sizes":[]},"element_pack_widget_effect_skewy_hover":{"unit":"px","size":"","sizes":[]},"element_pack_widget_effect_skewy_hover_tablet":{"unit":"px","size":"","sizes":[]},"element_pack_widget_effect_skewy_hover_mobile":{"unit":"px","size":"","sizes":[]},"element_pack_widget_effect_transition":"","element_pack_widget_effect_transition_delay":"","_transform_rotate_popover":"","_transform_rotateZ_effect":{"unit":"px","size":"","sizes":[]},"_transform_rotateZ_effect_tablet":{"unit":"deg","size":"","sizes":[]},"_transform_rotateZ_effect_mobile":{"unit":"deg","size":"","sizes":[]},"_transform_rotate_3d":"","_transform_rotateX_effect":{"unit":"px","size":"","sizes":[]},"_transform_rotateX_effect_tablet":{"unit":"deg","size":"","sizes":[]},"_transform_rotateX_effect_mobile":{"unit":"deg","size":"","sizes":[]},"_transform_rotateY_effect":{"unit":"px","size":"","sizes":[]},"_transform_rotateY_effect_tablet":{"unit":"deg","size":"","sizes":[]},"_transform_rotateY_effect_mobile":{"unit":"deg","size":"","sizes":[]},"_transform_perspective_effect":{"unit":"px","size":"","sizes":[]},"_transform_perspective_effect_tablet":{"unit":"px","size":"","sizes":[]},"_transform_perspective_effect_mobile":{"unit":"px","size":"","sizes":[]},"_transform_translate_popover":"","_transform_translateX_effect":{"unit":"px","size":"","sizes":[]},"_transform_translateX_effect_tablet":{"unit":"px","size":"","sizes":[]},"_transform_translateX_effect_mobile":{"unit":"px","size":"","sizes":[]},"_transform_translateY_effect":{"unit":"px","size":"","sizes":[]},"_transform_translateY_effect_tablet":{"unit":"px","size":"","sizes":[]},"_transform_translateY_effect_mobile":{"unit":"px","size":"","sizes":[]},"_transform_scale_popover":"","_transform_keep_proportions":"yes","_transform_scale_effect":{"unit":"px","size":"","sizes":[]},"_transform_scale_effect_tablet":{"unit":"px","size":"","sizes":[]},"_transform_scale_effect_mobile":{"unit":"px","size":"","sizes":[]},"_transform_scaleX_effect":{"unit":"px","size":"","sizes":[]},"_transform_scaleX_effect_tablet":{"unit":"px","size":"","sizes":[]},"_transform_scaleX_effect_mobile":{"unit":"px","size":"","sizes":[]},"_transform_scaleY_effect":{"unit":"px","size":"","sizes":[]},"_transform_scaleY_effect_tablet":{"unit":"px","size":"","sizes":[]},"_transform_scaleY_effect_mobile":{"unit":"px","size":"","sizes":[]},"_transform_skew_popover":"","_transform_skewX_effect":{"unit":"px","size":"","sizes":[]},"_transform_skewX_effect_tablet":{"unit":"deg","size":"","sizes":[]},"_transform_skewX_effect_mobile":{"unit":"deg","size":"","sizes":[]},"_transform_skewY_effect":{"unit":"px","size":"","sizes":[]},"_transform_skewY_effect_tablet":{"unit":"deg","size":"","sizes":[]},"_transform_skewY_effect_mobile":{"unit":"deg","size":"","sizes":[]},"_transform_flipX_effect":"","_transform_flipY_effect":"","_transform_rotate_popover_hover":"","_transform_rotateZ_effect_hover":{"unit":"px","size":"","sizes":[]},"_transform_rotateZ_effect_hover_tablet":{"unit":"deg","size":"","sizes":[]},"_transform_rotateZ_effect_hover_mobile":{"unit":"deg","size":"","sizes":[]},"_transform_rotate_3d_hover":"","_transform_rotateX_effect_hover":{"unit":"px","size":"","sizes":[]},"_transform_rotateX_effect_hover_tablet":{"unit":"deg","size":"","sizes":[]},"_transform_rotateX_effect_hover_mobile":{"unit":"deg","size":"","sizes":[]},"_transform_rotateY_effect_hover":{"unit":"px","size":"","sizes":[]},"_transform_rotateY_effect_hover_tablet":{"unit":"deg","size":"","sizes":[]},"_transform_rotateY_effect_hover_mobile":{"unit":"deg","size":"","sizes":[]},"_transform_perspective_effect_hover":{"unit":"px","size":"","sizes":[]},"_transform_perspective_effect_hover_tablet":{"unit":"px","size":"","sizes":[]},"_transform_perspective_effect_hover_mobile":{"unit":"px","size":"","sizes":[]},"_transform_translate_popover_hover":"","_transform_translateX_effect_hover":{"unit":"px","size":"","sizes":[]},"_transform_translateX_effect_hover_tablet":{"unit":"px","size":"","sizes":[]},"_transform_translateX_effect_hover_mobile":{"unit":"px","size":"","sizes":[]},"_transform_translateY_effect_hover":{"unit":"px","size":"","sizes":[]},"_transform_translateY_effect_hover_tablet":{"unit":"px","size":"","sizes":[]},"_transform_translateY_effect_hover_mobile":{"unit":"px","size":"","sizes":[]},"_transform_scale_popover_hover":"","_transform_keep_proportions_hover":"yes","_transform_scale_effect_hover":{"unit":"px","size":"","sizes":[]},"_transform_scale_effect_hover_tablet":{"unit":"px","size":"","sizes":[]},"_transform_scale_effect_hover_mobile":{"unit":"px","size":"","sizes":[]},"_transform_scaleX_effect_hover":{"unit":"px","size":"","sizes":[]},"_transform_scaleX_effect_hover_tablet":{"unit":"px","size":"","sizes":[]},"_transform_scaleX_effect_hover_mobile":{"unit":"px","size":"","sizes":[]},"_transform_scaleY_effect_hover":{"unit":"px","size":"","sizes":[]},"_transform_scaleY_effect_hover_tablet":{"unit":"px","size":"","sizes":[]},"_transform_scaleY_effect_hover_mobile":{"unit":"px","size":"","sizes":[]},"_transform_skew_popover_hover":"","_transform_skewX_effect_hover":{"unit":"px","size":"","sizes":[]},"_transform_skewX_effect_hover_tablet":{"unit":"deg","size":"","sizes":[]},"_transform_skewX_effect_hover_mobile":{"unit":"deg","size":"","sizes":[]},"_transform_skewY_effect_hover":{"unit":"px","size":"","sizes":[]},"_transform_skewY_effect_hover_tablet":{"unit":"deg","size":"","sizes":[]},"_transform_skewY_effect_hover_mobile":{"unit":"deg","size":"","sizes":[]},"_transform_flipX_effect_hover":"","_transform_flipY_effect_hover":"","_transform_transition_hover":{"unit":"px","size":"","sizes":[]},"motion_fx_transform_x_anchor_point":"","motion_fx_transform_x_anchor_point_tablet":"","motion_fx_transform_x_anchor_point_mobile":"","motion_fx_transform_y_anchor_point":"","motion_fx_transform_y_anchor_point_tablet":"","motion_fx_transform_y_anchor_point_mobile":"","_background_background":"","_background_color":"","_background_color_stop":{"unit":"%","size":0,"sizes":[]},"_background_color_stop_tablet":{"unit":"%"},"_background_color_stop_mobile":{"unit":"%"},"_background_color_b":"#f2295b","_background_color_b_stop":{"unit":"%","size":100,"sizes":[]},"_background_color_b_stop_tablet":{"unit":"%"},"_background_color_b_stop_mobile":{"unit":"%"},"_background_gradient_type":"linear","_background_gradient_angle":{"unit":"deg","size":180,"sizes":[]},"_background_gradient_angle_tablet":{"unit":"deg"},"_background_gradient_angle_mobile":{"unit":"deg"},"_background_gradient_position":"center center","_background_gradient_position_tablet":"","_background_gradient_position_mobile":"","_background_image":{"url":"","id":"","size":""},"_background_image_tablet":{"url":"","id":"","size":""},"_background_image_mobile":{"url":"","id":"","size":""},"_background_position":"","_background_position_tablet":"","_background_position_mobile":"","_background_xpos":{"unit":"px","size":0,"sizes":[]},"_background_xpos_tablet":{"unit":"px","size":0,"sizes":[]},"_background_xpos_mobile":{"unit":"px","size":0,"sizes":[]},"_background_ypos":{"unit":"px","size":0,"sizes":[]},"_background_ypos_tablet":{"unit":"px","size":0,"sizes":[]},"_background_ypos_mobile":{"unit":"px","size":0,"sizes":[]},"_background_attachment":"","_background_repeat":"","_background_repeat_tablet":"","_background_repeat_mobile":"","_background_size":"","_background_size_tablet":"","_background_size_mobile":"","_background_bg_width":{"unit":"%","size":100,"sizes":[]},"_background_bg_width_tablet":{"unit":"px","size":"","sizes":[]},"_background_bg_width_mobile":{"unit":"px","size":"","sizes":[]},"_background_video_link":"","_background_video_start":"","_background_video_end":"","_background_play_once":"","_background_play_on_mobile":"","_background_privacy_mode":"","_background_video_fallback":{"url":"","id":"","size":""},"_background_slideshow_gallery":[],"_background_slideshow_loop":"yes","_background_slideshow_slide_duration":5000,"_background_slideshow_slide_transition":"fade","_background_slideshow_transition_duration":500,"_background_slideshow_background_size":"","_background_slideshow_background_size_tablet":"","_background_slideshow_background_size_mobile":"","_background_slideshow_background_position":"","_background_slideshow_background_position_tablet":"","_background_slideshow_background_position_mobile":"","_background_slideshow_lazyload":"","_background_slideshow_ken_burns":"","_background_slideshow_ken_burns_zoom_direction":"in","_background_hover_background":"","_background_hover_color":"","_background_hover_color_stop":{"unit":"%","size":0,"sizes":[]},"_background_hover_color_stop_tablet":{"unit":"%"},"_background_hover_color_stop_mobile":{"unit":"%"},"_background_hover_color_b":"#f2295b","_background_hover_color_b_stop":{"unit":"%","size":100,"sizes":[]},"_background_hover_color_b_stop_tablet":{"unit":"%"},"_background_hover_color_b_stop_mobile":{"unit":"%"},"_background_hover_gradient_type":"linear","_background_hover_gradient_angle":{"unit":"deg","size":180,"sizes":[]},"_background_hover_gradient_angle_tablet":{"unit":"deg"},"_background_hover_gradient_angle_mobile":{"unit":"deg"},"_background_hover_gradient_position":"center center","_background_hover_gradient_position_tablet":"","_background_hover_gradient_position_mobile":"","_background_hover_image":{"url":"","id":"","size":""},"_background_hover_image_tablet":{"url":"","id":"","size":""},"_background_hover_image_mobile":{"url":"","id":"","size":""},"_background_hover_position":"","_background_hover_position_tablet":"","_background_hover_position_mobile":"","_background_hover_xpos":{"unit":"px","size":0,"sizes":[]},"_background_hover_xpos_tablet":{"unit":"px","size":0,"sizes":[]},"_background_hover_xpos_mobile":{"unit":"px","size":0,"sizes":[]},"_background_hover_ypos":{"unit":"px","size":0,"sizes":[]},"_background_hover_ypos_tablet":{"unit":"px","size":0,"sizes":[]},"_background_hover_ypos_mobile":{"unit":"px","size":0,"sizes":[]},"_background_hover_attachment":"","_background_hover_repeat":"","_background_hover_repeat_tablet":"","_background_hover_repeat_mobile":"","_background_hover_size":"","_background_hover_size_tablet":"","_background_hover_size_mobile":"","_background_hover_bg_width":{"unit":"%","size":100,"sizes":[]},"_background_hover_bg_width_tablet":{"unit":"px","size":"","sizes":[]},"_background_hover_bg_width_mobile":{"unit":"px","size":"","sizes":[]},"_background_hover_video_link":"","_background_hover_video_start":"","_background_hover_video_end":"","_background_hover_play_once":"","_background_hover_play_on_mobile":"","_background_hover_privacy_mode":"","_background_hover_video_fallback":{"url":"","id":"","size":""},"_background_hover_slideshow_gallery":[],"_background_hover_slideshow_loop":"yes","_background_hover_slideshow_slide_duration":5000,"_background_hover_slideshow_slide_transition":"fade","_background_hover_slideshow_transition_duration":500,"_background_hover_slideshow_background_size":"","_background_hover_slideshow_background_size_tablet":"","_background_hover_slideshow_background_size_mobile":"","_background_hover_slideshow_background_position":"","_background_hover_slideshow_background_position_tablet":"","_background_hover_slideshow_background_position_mobile":"","_background_hover_slideshow_lazyload":"","_background_hover_slideshow_ken_burns":"","_background_hover_slideshow_ken_burns_zoom_direction":"in","_background_hover_transition":{"unit":"px","size":"","sizes":[]},"element_pack_backdrop_filter":"","element_pack_bf_blur":{"unit":"px","size":"","sizes":[]},"element_pack_bf_brightness":{"unit":"px","size":"","sizes":[]},"element_pack_bf_contrast":{"unit":"px","size":"","sizes":[]},"element_pack_bf_grayscale":{"unit":"px","size":"","sizes":[]},"element_pack_bf_invert":{"unit":"px","size":"","sizes":[]},"element_pack_bf_opacity":{"unit":"px","size":"","sizes":[]},"element_pack_bf_sepia":{"unit":"px","size":"","sizes":[]},"element_pack_bf_saturate":{"unit":"px","size":"","sizes":[]},"element_pack_bf_hue_rotate":{"unit":"px","size":"","sizes":[]},"ep_background_overlay_background":"","ep_background_overlay_color":"","ep_background_overlay_color_stop":{"unit":"%","size":0,"sizes":[]},"ep_background_overlay_color_stop_tablet":{"unit":"%"},"ep_background_overlay_color_stop_mobile":{"unit":"%"},"ep_background_overlay_color_b":"#f2295b","ep_background_overlay_color_b_stop":{"unit":"%","size":100,"sizes":[]},"ep_background_overlay_color_b_stop_tablet":{"unit":"%"},"ep_background_overlay_color_b_stop_mobile":{"unit":"%"},"ep_background_overlay_gradient_type":"linear","ep_background_overlay_gradient_angle":{"unit":"deg","size":180,"sizes":[]},"ep_background_overlay_gradient_angle_tablet":{"unit":"deg"},"ep_background_overlay_gradient_angle_mobile":{"unit":"deg"},"ep_background_overlay_gradient_position":"center center","ep_background_overlay_gradient_position_tablet":"","ep_background_overlay_gradient_position_mobile":"","ep_background_overlay_image":{"url":"","id":"","size":""},"ep_background_overlay_image_tablet":{"url":"","id":"","size":""},"ep_background_overlay_image_mobile":{"url":"","id":"","size":""},"ep_background_overlay_position":"","ep_background_overlay_position_tablet":"","ep_background_overlay_position_mobile":"","ep_background_overlay_xpos":{"unit":"px","size":0,"sizes":[]},"ep_background_overlay_xpos_tablet":{"unit":"px","size":0,"sizes":[]},"ep_background_overlay_xpos_mobile":{"unit":"px","size":0,"sizes":[]},"ep_background_overlay_ypos":{"unit":"px","size":0,"sizes":[]},"ep_background_overlay_ypos_tablet":{"unit":"px","size":0,"sizes":[]},"ep_background_overlay_ypos_mobile":{"unit":"px","size":0,"sizes":[]},"ep_background_overlay_attachment":"","ep_background_overlay_repeat":"","ep_background_overlay_repeat_tablet":"","ep_background_overlay_repeat_mobile":"","ep_background_overlay_size":"","ep_background_overlay_size_tablet":"","ep_background_overlay_size_mobile":"","ep_background_overlay_bg_width":{"unit":"%","size":100,"sizes":[]},"ep_background_overlay_bg_width_tablet":{"unit":"px","size":"","sizes":[]},"ep_background_overlay_bg_width_mobile":{"unit":"px","size":"","sizes":[]},"ep_background_overlay_video_link":"","ep_background_overlay_video_start":"","ep_background_overlay_video_end":"","ep_background_overlay_play_once":"","ep_background_overlay_play_on_mobile":"","ep_background_overlay_privacy_mode":"","ep_background_overlay_video_fallback":{"url":"","id":"","size":""},"ep_background_overlay_slideshow_gallery":[],"ep_background_overlay_slideshow_loop":"yes","ep_background_overlay_slideshow_slide_duration":5000,"ep_background_overlay_slideshow_slide_transition":"fade","ep_background_overlay_slideshow_transition_duration":500,"ep_background_overlay_slideshow_background_size":"","ep_background_overlay_slideshow_background_size_tablet":"","ep_background_overlay_slideshow_background_size_mobile":"","ep_background_overlay_slideshow_background_position":"","ep_background_overlay_slideshow_background_position_tablet":"","ep_background_overlay_slideshow_background_position_mobile":"","ep_background_overlay_slideshow_lazyload":"","ep_background_overlay_slideshow_ken_burns":"","ep_background_overlay_slideshow_ken_burns_zoom_direction":"in","ep_background_overlay_opacity":{"unit":"px","size":0.5,"sizes":[]},"ep_css_filters_css_filter":"","ep_css_filters_blur":{"unit":"px","size":0,"sizes":[]},"ep_css_filters_brightness":{"unit":"px","size":100,"sizes":[]},"ep_css_filters_contrast":{"unit":"px","size":100,"sizes":[]},"ep_css_filters_saturate":{"unit":"px","size":100,"sizes":[]},"ep_css_filters_hue":{"unit":"px","size":0,"sizes":[]},"ep_overlay_blend_mode":"","ep_background_overlay_radius":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"ep_background_overlay_radius_tablet":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"ep_background_overlay_radius_mobile":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"ep_background_overlay_hover_background":"","ep_background_overlay_hover_color":"","ep_background_overlay_hover_color_stop":{"unit":"%","size":0,"sizes":[]},"ep_background_overlay_hover_color_stop_tablet":{"unit":"%"},"ep_background_overlay_hover_color_stop_mobile":{"unit":"%"},"ep_background_overlay_hover_color_b":"#f2295b","ep_background_overlay_hover_color_b_stop":{"unit":"%","size":100,"sizes":[]},"ep_background_overlay_hover_color_b_stop_tablet":{"unit":"%"},"ep_background_overlay_hover_color_b_stop_mobile":{"unit":"%"},"ep_background_overlay_hover_gradient_type":"linear","ep_background_overlay_hover_gradient_angle":{"unit":"deg","size":180,"sizes":[]},"ep_background_overlay_hover_gradient_angle_tablet":{"unit":"deg"},"ep_background_overlay_hover_gradient_angle_mobile":{"unit":"deg"},"ep_background_overlay_hover_gradient_position":"center center","ep_background_overlay_hover_gradient_position_tablet":"","ep_background_overlay_hover_gradient_position_mobile":"","ep_background_overlay_hover_image":{"url":"","id":"","size":""},"ep_background_overlay_hover_image_tablet":{"url":"","id":"","size":""},"ep_background_overlay_hover_image_mobile":{"url":"","id":"","size":""},"ep_background_overlay_hover_position":"","ep_background_overlay_hover_position_tablet":"","ep_background_overlay_hover_position_mobile":"","ep_background_overlay_hover_xpos":{"unit":"px","size":0,"sizes":[]},"ep_background_overlay_hover_xpos_tablet":{"unit":"px","size":0,"sizes":[]},"ep_background_overlay_hover_xpos_mobile":{"unit":"px","size":0,"sizes":[]},"ep_background_overlay_hover_ypos":{"unit":"px","size":0,"sizes":[]},"ep_background_overlay_hover_ypos_tablet":{"unit":"px","size":0,"sizes":[]},"ep_background_overlay_hover_ypos_mobile":{"unit":"px","size":0,"sizes":[]},"ep_background_overlay_hover_attachment":"","ep_background_overlay_hover_repeat":"","ep_background_overlay_hover_repeat_tablet":"","ep_background_overlay_hover_repeat_mobile":"","ep_background_overlay_hover_size":"","ep_background_overlay_hover_size_tablet":"","ep_background_overlay_hover_size_mobile":"","ep_background_overlay_hover_bg_width":{"unit":"%","size":100,"sizes":[]},"ep_background_overlay_hover_bg_width_tablet":{"unit":"px","size":"","sizes":[]},"ep_background_overlay_hover_bg_width_mobile":{"unit":"px","size":"","sizes":[]},"ep_background_overlay_hover_video_link":"","ep_background_overlay_hover_video_start":"","ep_background_overlay_hover_video_end":"","ep_background_overlay_hover_play_once":"","ep_background_overlay_hover_play_on_mobile":"","ep_background_overlay_hover_privacy_mode":"","ep_background_overlay_hover_video_fallback":{"url":"","id":"","size":""},"ep_background_overlay_hover_slideshow_gallery":[],"ep_background_overlay_hover_slideshow_loop":"yes","ep_background_overlay_hover_slideshow_slide_duration":5000,"ep_background_overlay_hover_slideshow_slide_transition":"fade","ep_background_overlay_hover_slideshow_transition_duration":500,"ep_background_overlay_hover_slideshow_background_size":"","ep_background_overlay_hover_slideshow_background_size_tablet":"","ep_background_overlay_hover_slideshow_background_size_mobile":"","ep_background_overlay_hover_slideshow_background_position":"","ep_background_overlay_hover_slideshow_background_position_tablet":"","ep_background_overlay_hover_slideshow_background_position_mobile":"","ep_background_overlay_hover_slideshow_lazyload":"","ep_background_overlay_hover_slideshow_ken_burns":"","ep_background_overlay_hover_slideshow_ken_burns_zoom_direction":"in","ep_background_overlay_hover_opacity":{"unit":"px","size":0.5,"sizes":[]},"ep_css_filters_hover_css_filter":"","ep_css_filters_hover_blur":{"unit":"px","size":0,"sizes":[]},"ep_css_filters_hover_brightness":{"unit":"px","size":100,"sizes":[]},"ep_css_filters_hover_contrast":{"unit":"px","size":100,"sizes":[]},"ep_css_filters_hover_saturate":{"unit":"px","size":100,"sizes":[]},"ep_css_filters_hover_hue":{"unit":"px","size":0,"sizes":[]},"ep_background_overlay_hover_transition_duration":{"unit":"px","size":0.3,"sizes":[]},"ep_background_overlay_hover_radius":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"ep_background_overlay_hover_radius_tablet":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"ep_background_overlay_hover_radius_mobile":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"ep_background_overlay_margin":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"ep_background_overlay_margin_tablet":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"ep_background_overlay_margin_mobile":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"ep_background_overlay_zindex":"","ep_background_overlay_position_relative":"","ep_background_overlay_widget_zindex":"-1","_border_border":"","_border_width":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_border_width_tablet":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_border_width_mobile":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_border_color":"","_border_radius":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_border_radius_tablet":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_border_radius_mobile":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_box_shadow_box_shadow_type":"","_box_shadow_box_shadow":{"horizontal":0,"vertical":0,"blur":10,"spread":0,"color":"rgba(0,0,0,0.5)"},"_box_shadow_box_shadow_position":" ","_border_hover_border":"","_border_hover_width":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_border_hover_width_tablet":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_border_hover_width_mobile":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_border_hover_color":"","_border_radius_hover":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_border_radius_hover_tablet":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_border_radius_hover_mobile":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_box_shadow_hover_box_shadow_type":"","_box_shadow_hover_box_shadow":{"horizontal":0,"vertical":0,"blur":10,"spread":0,"color":"rgba(0,0,0,0.5)"},"_box_shadow_hover_box_shadow_position":" ","_border_hover_transition":{"unit":"px","size":"","sizes":[]},"_mask_switch":"","_mask_shape":"circle","_mask_image":{"url":"","id":"","size":""},"_mask_notice":"","_mask_size":"contain","_mask_size_tablet":"","_mask_size_mobile":"","_mask_size_scale":{"unit":"%","size":100,"sizes":[]},"_mask_size_scale_tablet":{"unit":"px","size":"","sizes":[]},"_mask_size_scale_mobile":{"unit":"px","size":"","sizes":[]},"_mask_position":"center center","_mask_position_tablet":"","_mask_position_mobile":"","_mask_position_x":{"unit":"%","size":0,"sizes":[]},"_mask_position_x_tablet":{"unit":"px","size":"","sizes":[]},"_mask_position_x_mobile":{"unit":"px","size":"","sizes":[]},"_mask_position_y":{"unit":"%","size":0,"sizes":[]},"_mask_position_y_tablet":{"unit":"px","size":"","sizes":[]},"_mask_position_y_mobile":{"unit":"px","size":"","sizes":[]},"_mask_repeat":"no-repeat","_mask_repeat_tablet":"","_mask_repeat_mobile":"","hide_desktop":"","hide_tablet":"","hide_mobile":"","_attributes":"","custom_css":""},"defaultEditSettings":{"defaultEditRoute":"content"},"elements":[],"widgetType":"theme-post-featured-image","htmlCache":"\t\t\n\t\t\t\t\t\t\t\t\t\t\t\t\t\t\t\t\t\t\t\t\t\t\t\t\t\t\n\t\t","editSettings":{"defaultEditRoute":"content","panel":{"activeTab":"content","activeSection":"section_image"}}}]}](https://ktwealthmanagement.com/wp-content/uploads/2024/07/ycharts-SPY-performance-throughout-presidencies-.webp)

How did markets perform under different presidents?

The S&P500 has consistently grown in value over the long term, no matter who’s in office.

His Ex is getting his $1million retirement account

Beneficiary designations trump wills in court.

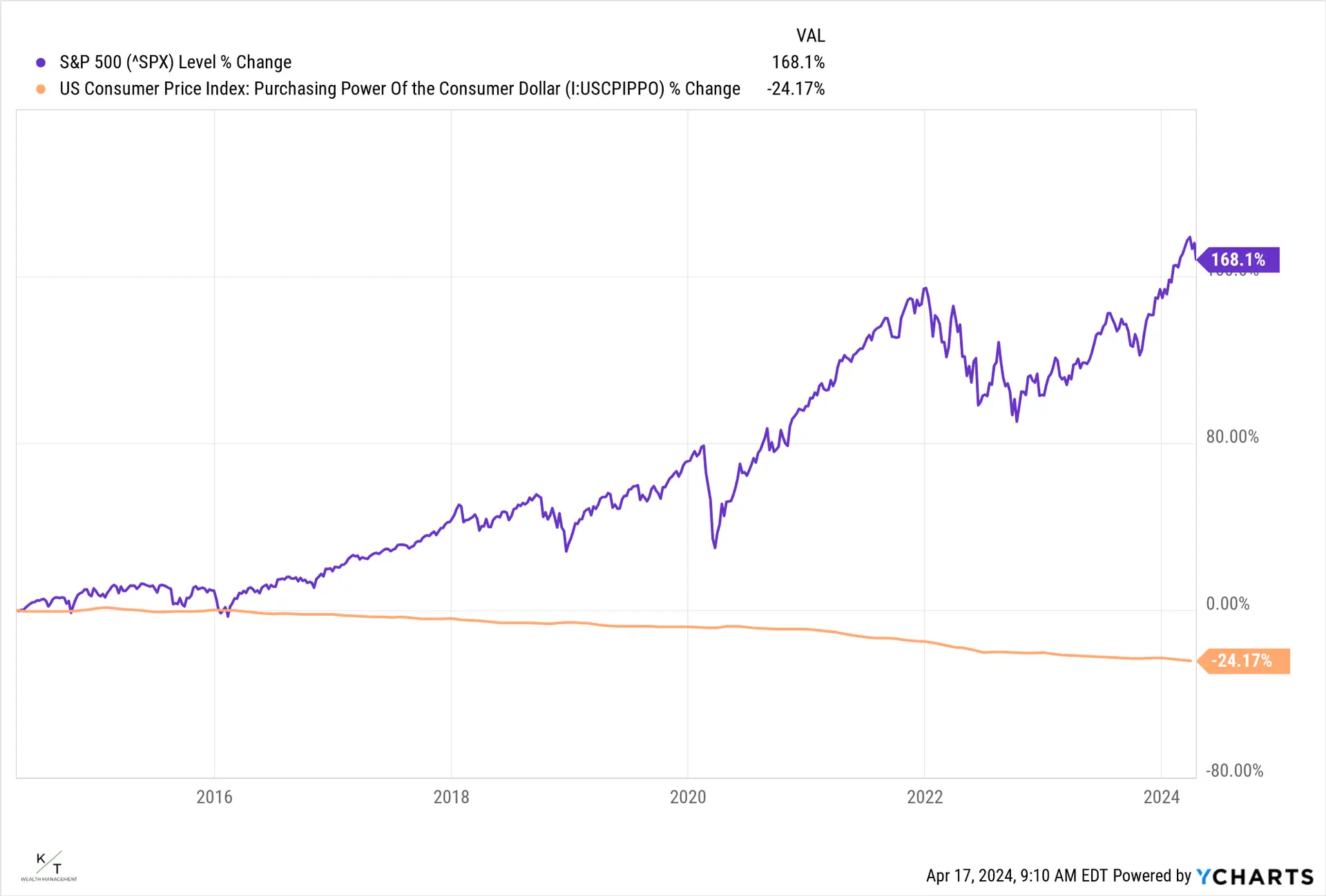

This is why we invest. In one chart.

Over the last 10 years, our purchasing power has dropped by 24.17% due to inflation.

Don’t Let Your Old 401k Gather Dust! Know Your Options

There is no one size fits all answer as everyone’s situation is unique.

Optimal Order of Investing Your Money

Here’s my take on the optimal order of investing your money.

Roth IRA Benefits + 5 Year Rules

Roth CONTRIBUTIONS are accessible tax & penalty free at any age and regardless of reason.

Which is better? Lump sum or Dollar Cost Average $100k?

Investing a lump sum immediately has historically helped maximize returns.

Applying for Social Security benefits? Things to consider

There is no one size fits all answer as everyone’s situation is unique.

Thoughts on the Market

Some negative news about home sales and consumer confidence created fresh concerns about the state of the economy.

Retirement Options for Self-Employed Business Owners

Self-employed business owners have several retirement options when planning for their financial future. These options allow them to save for retirement and potentially enjoy tax advantages.

Restricted Stock Units (RSUs)

Some employers offer incentive stock options (ISOs), restricted stock units (RSUs), performance shares, or employee stock purchase plans (ESPP).

Tapping a Roth IRA Early

You can access your CONTRIBUTIONS whenever you want – penalty & tax free

What You Need To Know About Delaware Statutory Trusts

DSTs or Delaware Statutory Trusts are continuing to be a viable option for many real estate owners that are entering retirement looking to relieve themselves of landlord duty and are tired of dealing with tenants, toilets and trash! Here’s a 60-sec version on how DSTs work.

529 Rollovers

529 accounts are getting a lot more powerful with the recent SECURE Act 2.0 legislation that went into effect on January 1st.

The 5 “Hidden” Tax Opportunities To Take Advantage of NOW

There is potentially an extremely limited opportunity to leverage current laws. The 2021 tax year may be the last chance to take advantage of these rules.

How the Internet Gamed Wall Street’s Short Sellers

You may have heard the news about stocks for certain companies suddenly ballooning, quickly going from lunch money prices to several hundred dollars a share. In one case, the shares rose over 1700% since December 2020.

Does Main Street Need a Wall Street Strategy?

As Wall Street pushes higher, a pandemic-weary Main Street is relearning how to manage cash flow with the hope of keeping its retirement dreams alive.

Coronavirus Vaccines and the Economy

As the United States sees a rise in cases of COVID-19 across the nation, news of two promising vaccines out of hundreds being tested has offered a ray of hope for a fatigued world.

2021 Limits for IRAs, 401(k)s and More

On October 26, the Treasury Department released the 2021 adjusted figures for retirement account savings. Although these adjustments won’t bring any major changes, there are some minor elements to note.

Election 2020: A Dose of Patience

45% of consumers with $100,000 or more investable assets expect to make changes to their portfolio due to the 2020 presidential election.

Election 2020: Be Confident. Be Bold. Be Patient

More than 90% of investors say they plan to change their portfolio in the 12 months following the election.

Ouch! September’s Market Correction Hurt

Investors learned that the Fed plans to keep short-term interest rates low for an extended period of time.

Election 2020: Preparing for Any Outcome

As the U.S. presidential election draws near, expect to see more and more headlines that propose, “What will happen next if this person is elected?” or, “What policy changes to prepare for in the next four years?”

2020 RMD Income Tax Relief is possible

Are you one of the many retirement account holders who took a mandatory distribution this year?

How Much Money Will You Need for Retirement?

$1.9 million is the number, according to a nationwide survey of 1,000 employed 401(k) participants by a well-known financial services company.

An Unprecedented Rush to Cash

The Bureau of Economic Analysis reported on May 29th that the personal savings rate hit a historic 33% in April.

What If You missed the Five Best Days?

Hindsight is 20/20. It’s only human to imagine what it might have been like to turn left instead of right on some fateful day.

Market Behavior and the Economy

As states cautiously begin the process of relaxing their COVID-19 restrictions, some are wondering, “Why is the stock market doing so well when the economy is doing so poorly?”